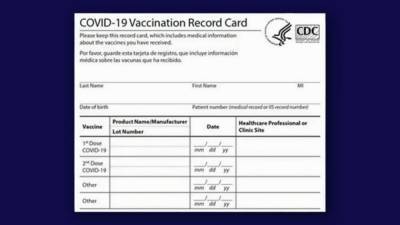

How much tax you can save via health insurance

Also Read | Six wrong calls on post-covid economy However, one can only claim a deduction for parents and not for parents-in-law.

In that case, if your spouse is also working, she can also save tax by buying health insurance for her parents and claim a deduction for up to ₹50,000.

This way, you can maximize tax savings deduction benefit on your entire family income."Irrespective of paying a premium for either your single parent or both parents, as per the provisions of Income-tax Act, you would be able to claim a deduction of the total amount of premium paid subject to a maximum of ₹25,000.

This limit can further increase to ₹50,000 in case your parents are senior citizen (that is, equal to or more than 60 years of age)," said Vishwajeet.

Read more on livemint.com