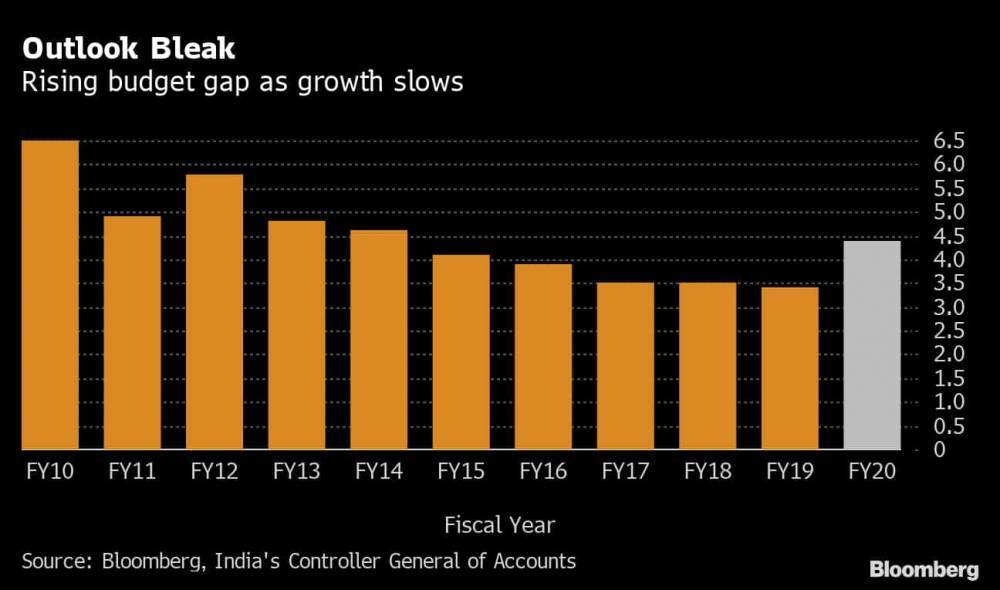

Raising tax rates in slowdown can hamper revenue

Mint explains the relationship between tax rates, tax revenue and GDP growth to argue why taxes should not be raised during a slowdown The Centre has distanced itself from a report containing proposals to raise taxes for tackling the economic fallout of the covid-19 pandemic.

Mint explains the relationship between tax rates, tax revenue and GDP growth to argue why taxes should not be raised during a slowdown.

What proposals were made in the report? The report contained a road map with specific suggestions on the revenue and expenditure side.

Some of these suggestions were an increase in the peak tax rate to 40%, introduction of a 4% cess on those with incomes above ₹10 lakh and the introduction of wealth and inheritance taxes.

Read more on livemint.com