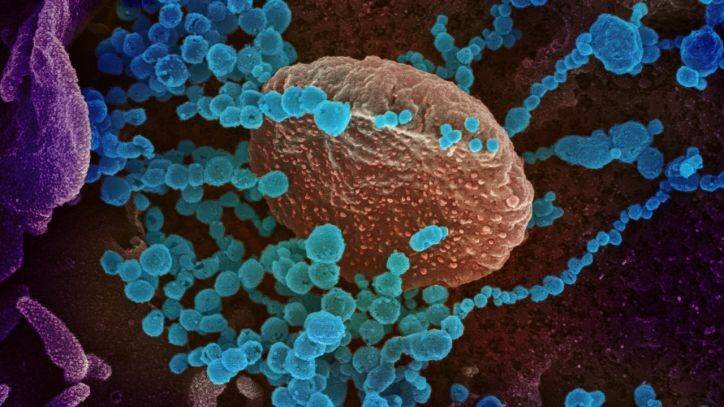

Covid-19 effect: Liquidity, liquidity everywhere but not a drop to lend

The country’s lenders chose to park a record ₹6.9 trillion with the Reserve Bank of India (RBI) on Monday for a paltry return of 4%, even though buying government bonds or giving out loans would have got them higher rates.

As the adjoining chart shows, banks have been keeping a colossal amount of money with RBI. The reasons behind this are many.

First, demand for loans is very low, considering that the lockdown has reduced business activity to a minimum. Loans are being largely taken for working capital or for refinancing scheduled repayments.

The three-month repayment holiday given by banks means that refinancing needs are also very low. But whatever demand for funds comes must also pass the trust filter of lenders.

Read more on livemint.com