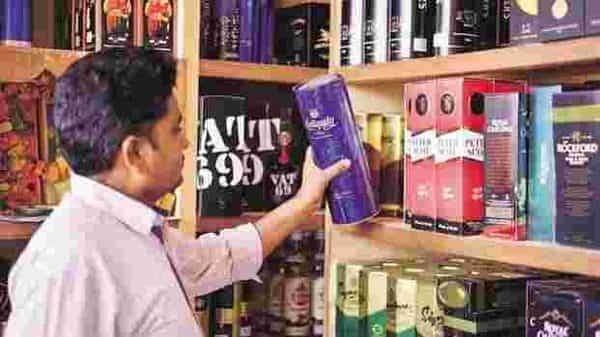

Sebi may consider easier fundraising via preferential allotment

MUMBAI: Markets regulator, Securities and Exchange Board of India (Sebi), is likely to consider relaxing pricing norms for preferential allotment that will allow listed companies to raise funds at a time when businesses are under pressure due to the covid-19 pandemic, said two people aware of the development.

Currently, pricing of a preferential allotment cannot be less than the average of weekly high and low for 26 weeks and average of weekly high and low for two weeks preceding the relevant date.

Recently, Sebi had proposed easing the pricing of a preferential allotment for stressed companies by allowing it to be determined only on the average of the previous two weeks price of the shares, as on the relevant date.

Read more on livemint.com