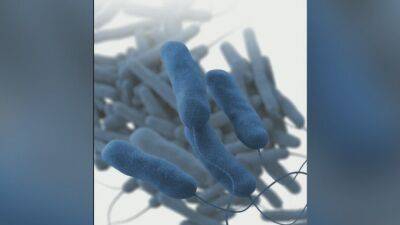

Centre notifies new condition for tax exemption given to Covid aid

₹10 lakh. Such sum will not be counted as taxable under the head ‘income from other sources,’ if it meets all the conditions.

The order also said that the family member of the individual should keep a record of a list of documents including the Covid-19 positive report of the individual or medical report if clinically determined to be Covid-19 positive through investigations in a hospital or at any other facility.

Also, details of such funds received have to be reported in a specified form latest by end of December 2022, the order said. “CBDT has issued notifications on 5 August, 2022 prescribing conditions for claiming exemption in respect of a perquisite by way of reimbursement by the employer in respect of any expenditure for treatment of any illness relating to Covid-19.

CBDT also has issued notification prescribing conditions for exemption from tax under section 56(2)(x) in respect of amount received from unrelated person for treatment of illness relating to Covid and also in respect of amount received from employer or any other person by the family of the deceased who died due to Covid -19 illness," said Ved Jain, former president of Institute of Chartered Accountants of India (ICAI).

Read more on livemint.com