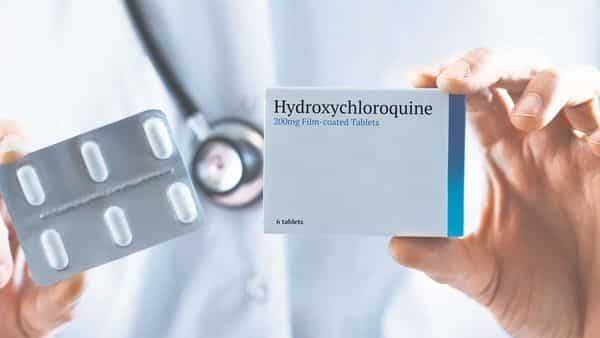

Delinquencies likely to rise once the moratorium on loans gets over: Nitin Chugh

No one knows by what proportion the delinquencies will rise, so it’s best to stay in touch with customers Banks’ lending activities have stopped since the lockdown started.

In addition, the moratorium on loans will make it difficult for banks to assess delinquencies. Nitin Chugh, MD and CEO, Ujjivan Small Finance Bank, discusses the impact of the covid-19 pandemic and the measures banks are taking to resume lending activities How do small finance banks manage to give higher interest rates on fixed deposits (FDs) compared to universal banks?

Some offer higher rates for specific maturities? How? It has little to do with being a small finance bank. We are new banks and do not have a high proportion of Casa (current account and savings

Read more on livemint.com