Loan EMIs set to get cheaper as RBI cuts repo rate

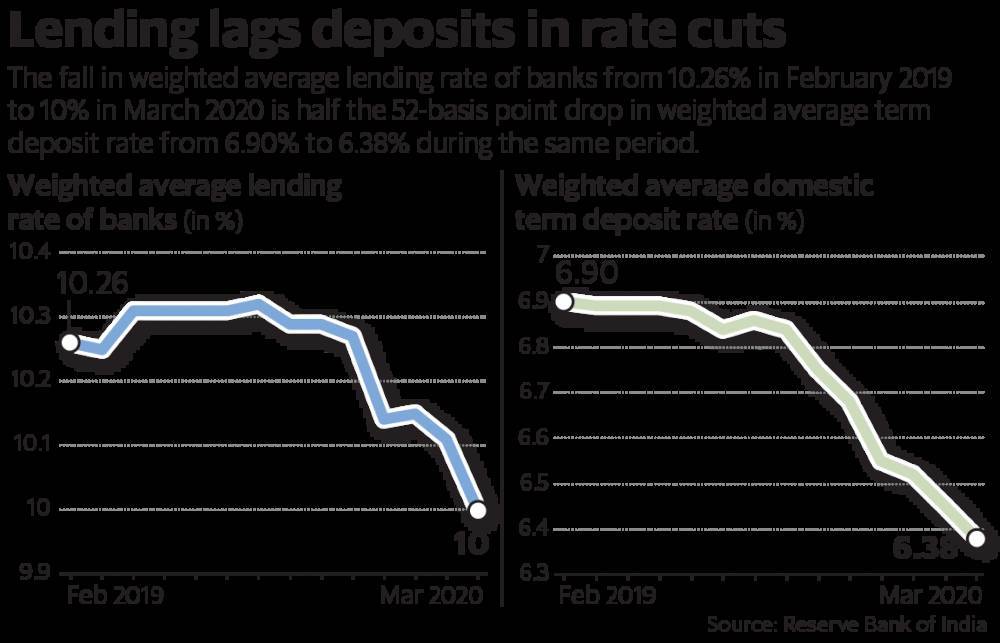

The Reserve Bank of India has cut key repo lending rate by 40 basis points to 4%. This is expected to bring down lending rates and deposit rates as well.

RBI's monetary policy committee in an off-cycle meeting voted 5-1 for a 40 bps repo rate cut, while maintaining an accommodative stance.

Reverse repo gets automatically gets adjusted to 3.35% from 3.75%. The RBI on 27 March had slashed the repo rate by 75 bps to stimulate growth, following which, banks lowered their lending rates and deposit rate. "We must have faith in India's resilience and come out of all odds," the RBI chief said, adding that the inflation outlook is uncertain at this point.

Read more on livemint.com