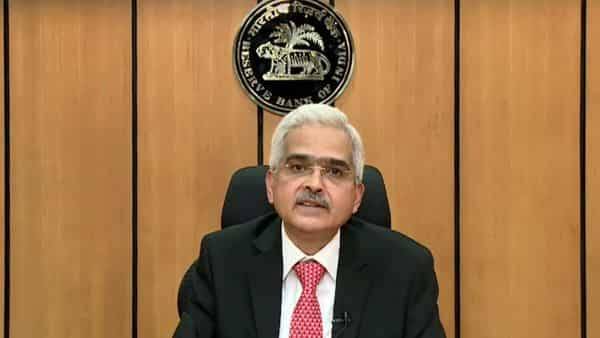

RBI’s moves may not snap banks’ wariness to lend

Reserve Bank of India (RBI) governor Shaktikanta Das announced a series of measures on Friday to encourage banks to lend. This comes after non-food credit growth fell to a 26-year low in 2019-20.

Will RBI’s new moves encourage banks to lend more? Mint takes a look. Click here to enlarge graphic How did non-food credit fare in 2019-20? Non-food credit grew 6.1% in 2019-20, the lowest since 1993-94, when it was 5.7% (see Chart 1).

It’s also the third-slowest growth in the last 60 years. The slowest growth was 5.4% and it took place in 1961-62. Banks lend money to the Food Corporation of India and other state procurement agencies to buy rice and wheat directly from farmers, primarily to meet the country’s food security needs.

Read more on livemint.com