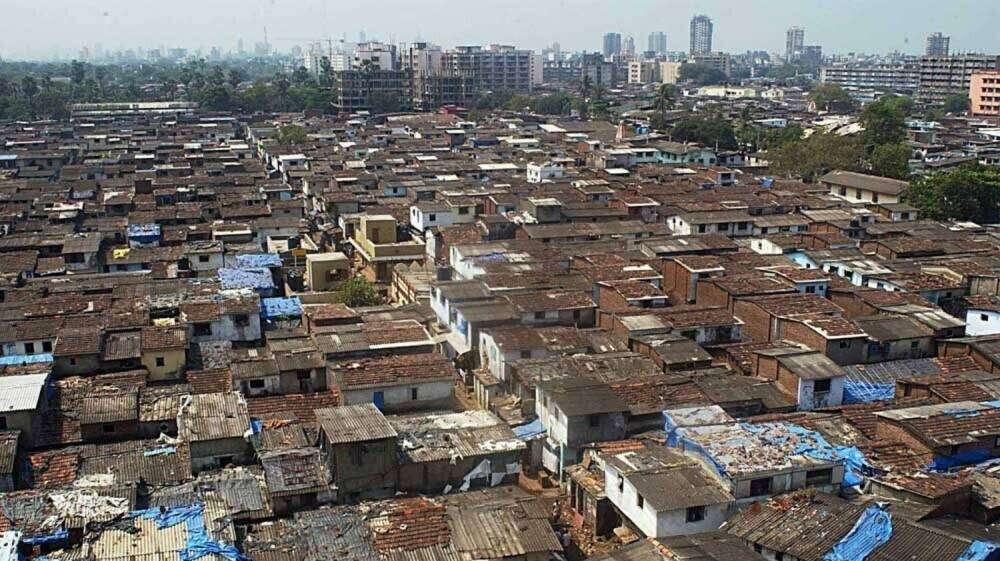

Mutual funds’ steady SIP flows face their biggest ever test yet

Domestic institutional investors (DIIs) have traditionally acted as a backstop whenever there is heavy selling by foreign portfolio investors (FPIs).

When the market fell by 60% between January and October 2008, DII net purchases worth $15 billion helped absorb FPI selling worth $13.1 billion, data collated by UBS Securities India Pvt.

Ltd shows. However, the role of mutual funds was relatively small back then, accounting for less than 20% of net purchases by DIIs.

With the surge in inflows into mutual funds in recent years, their role in the markets has increased considerably. Between 24 February and 23 March this year, while FPIs sold equities worth ₹65,371 crore ($8.73 billion), purchases by mutual funds stood at ₹32,448 crore ($4.33

Read more on livemint.com