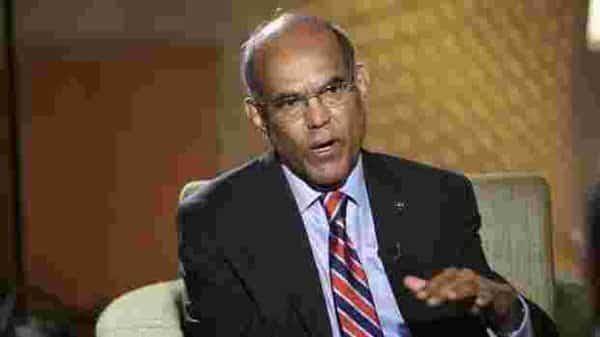

Have RBI measures for faster rate cut transmission borne fruit for borrowers?

The Reserve Bank of India (RBI) last week announced a cut of 40 basis points (bps) in repo rates to 4%. RBI’s Monetary Policy Committee (MPC) has slashed the external benchmark rate by a total of 115 bps since the lockdown to combat covid-19 began.

Moreover, citing the need to mitigate the impact of covid-19 and revive growth while ensuring that inflation remains within the target, RBI had slashed the repo rate by 75 bps on 27 March.

Following this, banks lowered their lending rates. But the benefits of this massive cut may not come at the same time for all borrowers.

Here’s what to expect. The MCLR lag According to experts, those who are servicing MCLR-based loans might have to wait for reduction in their interest rates. “The 40 basis

Read more on livemint.com