India's savers should brace for more pain in this round of rate cuts

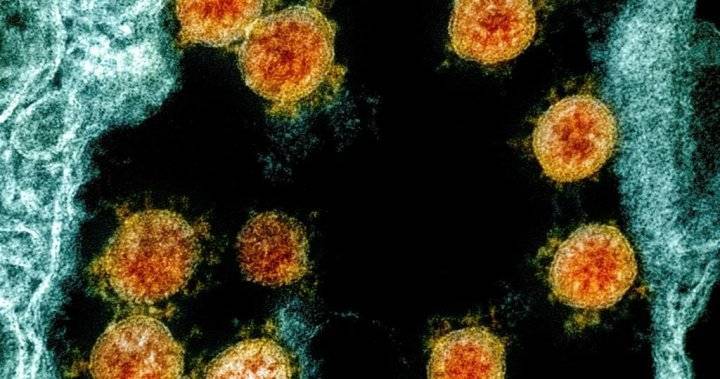

The covid-19 pandemic has prompted policymakers to rush to protect the borrowers from its impact. Inadvertently as always, the savers of the country will be collateral damage.

One sign of this is the falling interest rate on deposits of the country’s largest bank, State Bank of India (SBI). The unprecedented surplus liquidity, rush to safety of deposits and the policy rate cuts so far has meant that SBI has axed its deposit rates twice in just a month now.

Its one year deposit rate is at its lowest in 17 years. It is natural that most other banks would follow suit and cut deposit rates now.

To be sure, the weighted average term deposit rate declined by 53 basis points between January and March. “In the banking space, we see that the PSBs,

Read more on livemint.com