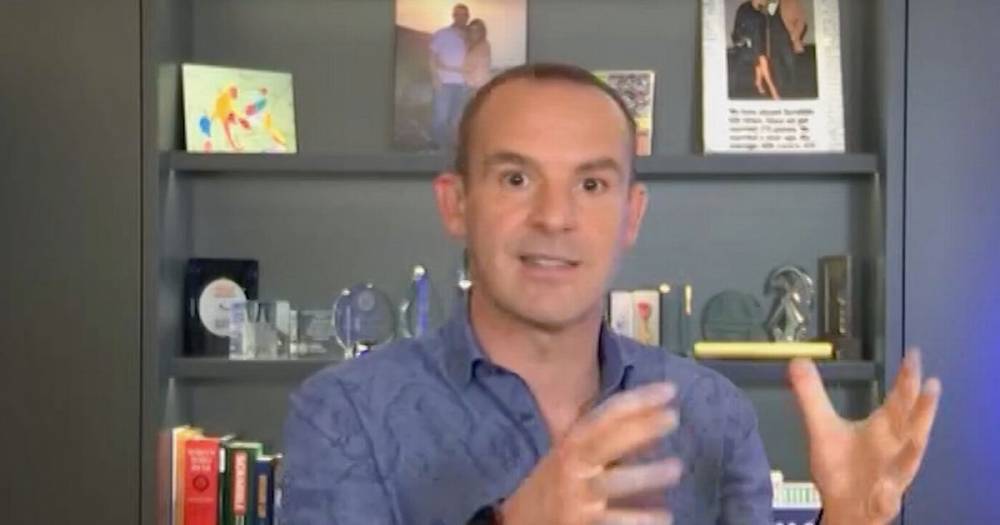

Martin Lewis urges banks to stop sending 'thuggish' debt letters during Covid-19

Thuggish letters which could ruin the lives of people who have problems with debt should be stopped during the coronavirus pandemic, Martin Lewis has urged.

The Consumer Credit Act 1974 dictates what appears in letters to a number of documents including overdraft, credit card and payday loans, says the Money and Mental Health Policy Institute.

But out-of-date laws which force lenders to send such letters should be changed as part of coronavirus crisis financial support measures, says the charity which was founded by Martin.

A “stop the debt threats” campaign is calling for rules to be updated to make letters less threatening and distressing especially during the health crisis.

Read more on dailystar.co.uk