Stimulus Information & Wednesday, April 22, Noon Deadline for Social Security Beneficiaries with Children

Non-Filers: Enter Your Information Here for the IRS The CARES Act provides economic impact payments of up to $1,200 for individuals or $2,400 for married couples and up to $500 for each qualifying child.

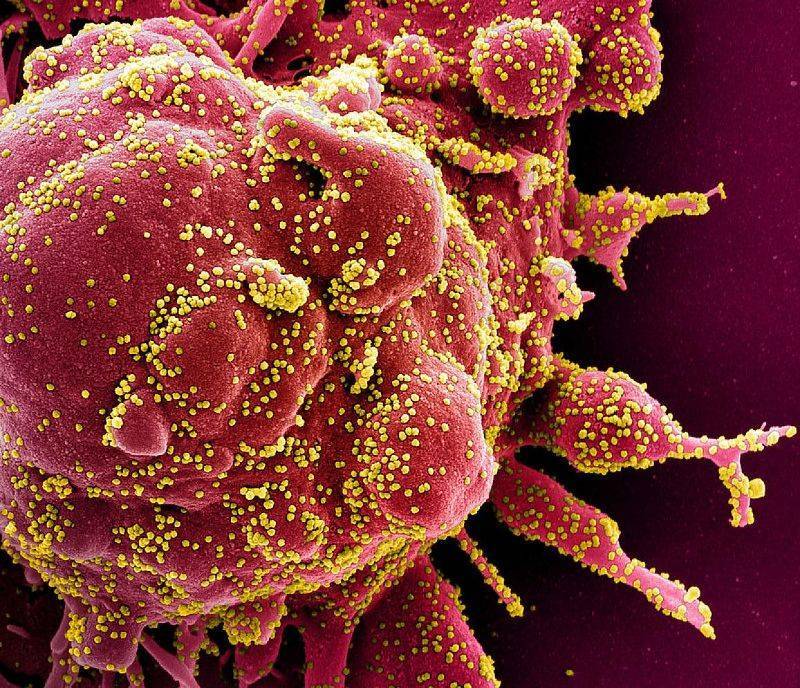

Eligible Social Security (including SSDI and SSI), Veterans Administration, and Railroad Retirement beneficiaries who don’t normally file taxes will automatically receive payments of $1,200.

Any of these beneficiaries who have qualifying children under age 17 and did not file 2018 or 2019 taxes must use the Non-Filers: Enter Payment Info tool on IRS.gov to claim the $500 payment per child.

Note that economic impact payments will not be counted as income for SSI recipients, and the payments are excluded from resources for 12 months.

Read more on acl.gov