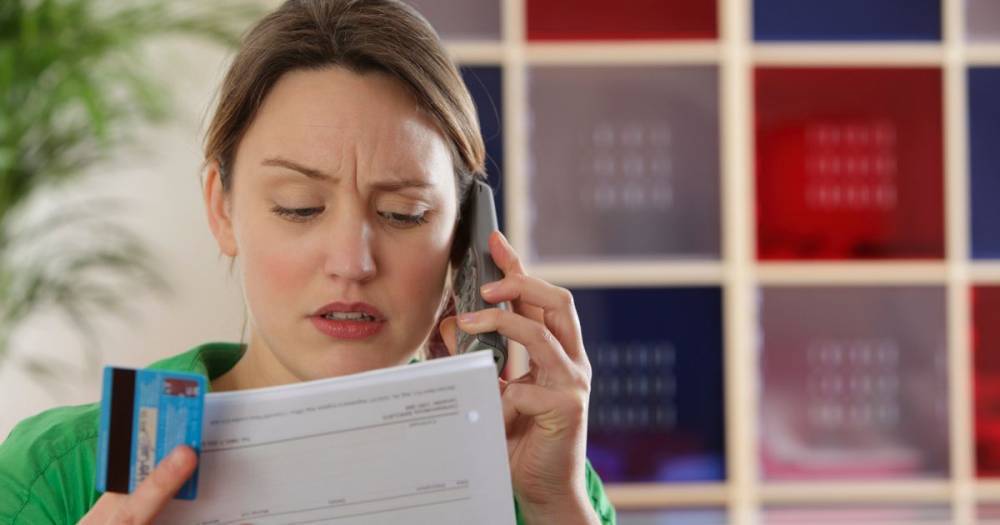

Avalanche or snowball: which is your debt plan?

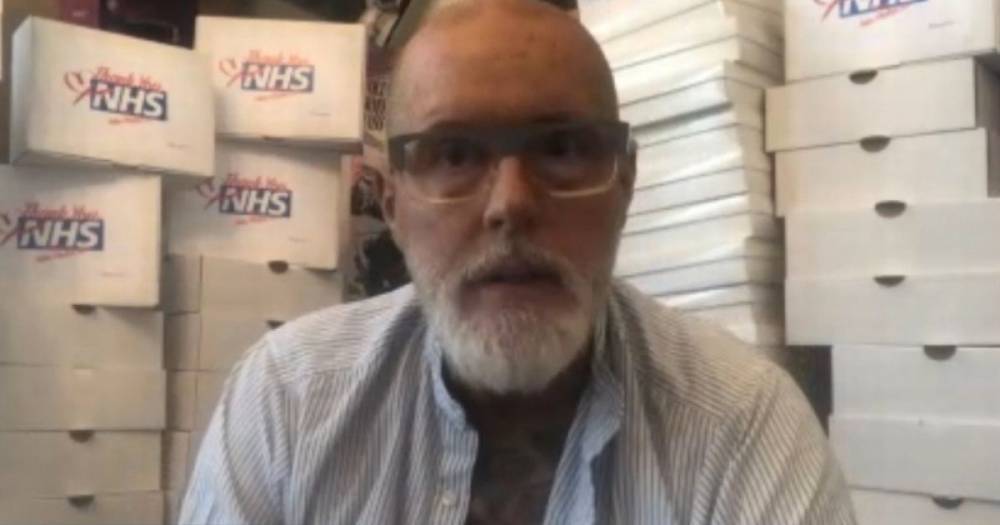

When working as a debt counsellor with Abhay Credit Counselling Centre, an initiative by the Bank of India, V.N. Kulkarni advised borrowers who were drowning in debt.

There was one thing common among the majority of the cases. The borrowers spent heavily on credit cards and then kept paying the minimum amount due, which is, typically, 5% of the outstanding.

Paying the minimum amount is a sure-shot recipe for financial disaster. “It was one of the key reasons for people to fall in a debt trap," said Kulkarni, who is also a retired banker.

Take an example of a cardholder who has ₹2 lakh outstanding and the issuer charges an annual percentage rate or APR of 40%. After five years, the cardholder will still have an outstanding balance of

Read more on livemint.com