Understand the risks before investing in fixed maturity plans

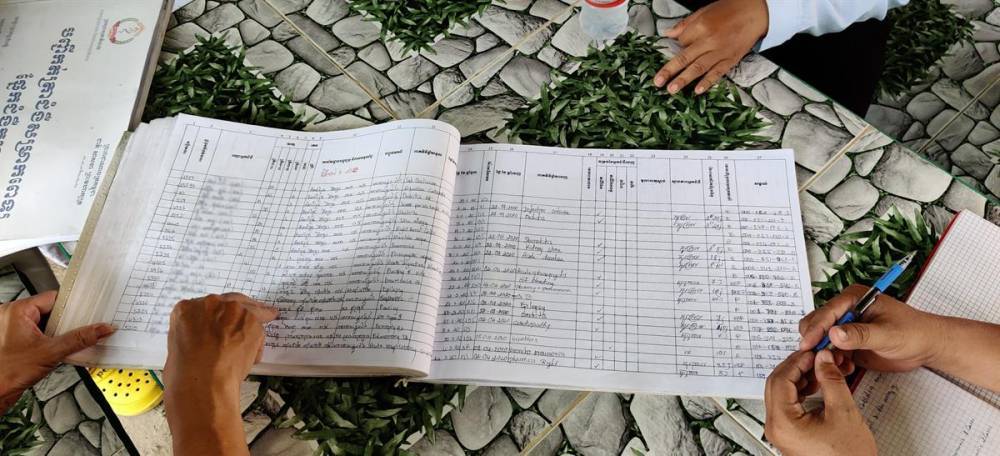

Fixed maturity plans (FMPs), which are a close relative of fixed deposits (FDs), have fixed opening and maturity dates, and if they are held to maturity, they give predictable returns.

However, FMPs are exposed to a lot more credit risk. As aggressive credit bets in FMPs soured, the industry itself turned away from them.

Launches of close-ended funds (most of which are FMPs) plunged from 526 in FY19 to just 94 in FY20, data from Pulse Labs showed.

Due to their FD-like nature, FMPs were prone to mis-selling. But it’s not just FMPs, other close-ended funds have also been mis-sold in the past.

Read more on livemint.com